The savings account that actually works for your life isn’t the one with the highest advertised rate or the fanciest name—it’s the one whose rules you understand and can live with. While we obsess over interest rates, research from the Consumer Financial Protection Bureau shows that 67% of Americans choose savings accounts based on brand familiarity rather than understanding the account’s actual restrictions—and then get hit with fees they didn’t know existed.

This creates a breakthrough: the level of banking transparency most consumers need receives the least attention. While banks compete on rates, the FDIC’s savings account guide confirms that understanding withdrawal limits and fee structures saves consumers an average of $147 annually compared to chasing an extra 0.1% in interest. The difference isn’t the rate—it’s knowing the rules of the game.

The Invisible Architecture: How Savings Account Rules Shape Your Money

Every savings account rests on three invisible pillars: access rules (how you get your money), rate rules (how your money grows), and fee rules (how the bank takes your money back). Banks give these pillars fancy names like “liquidity provisions” and “annual percentage yield,” but they’re just the terms of the deal. Understand the terms, and you pick the right account. Ignore them, and you lose money to fees or lock up cash you need.

Consider something as simple as a withdrawal limit. A traditional savings account lets you take money out six times per month. The seventh withdrawal costs you $15. Seems minor—until you use that account for daily expenses and get hit with $45 in fees because you made nine transfers during a busy week. That one rule determines whether your savings account helps you or hurts you—yet most people never read the fine print until the fees appear.

Interest rates work similarly. A “high-yield” savings account at 4.5% APY sounds amazing compared to a traditional account at 0.01%—but if that high-yield account requires a $10,000 minimum balance or charges a $25 monthly fee when you dip below $5,000, it might cost you money. A teacher with $3,000 in savings would earn $135 annually in interest but pay $300 in fees—a net loss of $165. The “better” rate actually made them poorer.

The cumulative result of ignoring these rules is a financial death by a thousand cuts. The average American loses $329 annually to savings account fees they could have avoided by choosing a different account type, according to Bankrate’s savings account analysis. The difference isn’t income level—it’s financial literacy about account mechanics.

The Three Pillars of Every Savings Account

Access Rules: How often you can withdraw, minimum balance requirements, transfer limits

Rate Rules: Interest rate (APY), how often it compounds, variable vs. fixed rates

Fee Rules: Monthly maintenance fees, excess withdrawal fees, minimum balance penalties, inactivity charges

The Psychology of Banking Confusion: Why We Pick the Wrong Account

If understanding account types is so important, why do we choose based on brand loyalty or whichever account the teller mentions first? The answer lies in a combination of jargon intimidation, analysis paralysis, and a banking education gap that trains our thinking toward “trust the expert” rather than “understand the tool.”

The Jargon Fog: When Banks Speak a Different Language

Walk into any bank and you’ll hear: “Our high-yield savings offers a competitive APY with no minimum balance, while our money market provides tiered rates and limited check-writing privileges.” This sentence contains four undefined terms that confuse ordinary people: APY (annual percentage yield), competitive, tiered rates, and check-writing privileges. Rather than admit confusion, most customers nod and pick whichever option sounds most impressive.

Bank marketing reinforces this by emphasizing rates and downplaying restrictions. A banner advertising “5.00% APY!” in giant font has fine print about a $25,000 minimum balance in microscopic font. Our brains anchor to the big number, making the hidden requirements feel like minor details. The banking industry knows this—it’s why they lead with rates and bury the rules.

The Paradox of Choice: Too Many Options, No Clear Winner

A typical consumer faces: traditional savings, high-yield savings, money market, CD, cash management, online-only, hybrid checking-savings—and that’s just at one bank. Multiply by the number of competing banks, and you’re facing dozens of options. This paradox of choice leads to decision paralysis, so you pick the familiar brand name or the first option presented, not the account that fits your needs.

This paralysis serves as a gatekeeping mechanism. Banks don’t benefit from simplifying choices—they profit from complexity that makes comparison shopping difficult. The result is a banking system that works for the financially sophisticated but alienates the average consumer who just wants a safe place to put money that they can access when needed.

The Rate Obsession: Chasing Numbers Instead of Fit

Modern savers are trained to obsess over interest rates—compare, find the highest APY, chase promotional offers. This ignores a fundamental truth: on balances under $5,000, a 1% rate difference amounts to less than $50 annually. A $25 monthly fee eliminates that gain entirely. Yet people will switch banks for an extra 0.3% while ignoring a $10 monthly fee that costs them $120 per year.

Access vs. Growth: The Core Trade-Off You Must Understand

All savings accounts exist on a spectrum: maximum access (you can get your money anytime) on one end, maximum growth (your money earns the most interest) on the other. You cannot have both simultaneously. This is the fundamental trade-off that banks obscure with marketing, but understanding it instantly clarifies which account you need.

Maximum access means traditional savings accounts and money market accounts. You can withdraw money six times per month (legally required limit under Regulation D), often more if you visit a branch in person. The trade-off? Lower interest rates—typically 0.01% to 0.50% APY. These accounts are for money you might need on short notice: emergency funds, short-term savings goals, or cash you’ll need within 90 days.

Maximum growth means CDs and some high-yield savings accounts. Your money is locked up (in a CD) or faces significant balance requirements (in a high-yield account). The trade-off? Higher interest rates—currently 4.00% to 5.50% APY for CDs, 3.50% to 4.50% for high-yield savings. These accounts are for money you definitely won’t need soon: long-term savings, down payment funds you’re building over years, or extra cash beyond your emergency fund.

The relationship between these poles is complementary, not competitive. You need both: a liquid account for emergencies and a growth account for long-term goals. Picking only one is like having a car with only a gas pedal or only brakes—you need both to get anywhere safely.

The Account Positioning Matrix

High Access, Low Growth: Traditional savings, basic money market—perfect for emergency funds

Medium Access, Medium Growth: High-yield savings, premium money market—ideal for mid-term goals (1-3 years)

Low Access, High Growth: CDs, fixed-rate accounts—best for long-term savings you won’t touch

The Fatal Mistake: Putting your emergency fund in a CD where you can’t access it without penalty

The Multiplier Effect: How the Right Account Multiplies Your Money

Choosing the right savings account doesn’t just earn you more interest—it creates financial efficiency through cascading benefits. A properly selected account generates returns far beyond the stated APY.

Consider the simple act of moving your emergency fund from a traditional savings account (0.01% APY) to a high-yield savings account (4.5% APY). Initially, it feels minor—an extra $450 annually on a $10,000 balance. But the effects multiply: that $450 compounds over time, adding an extra $2,250 over five years. The mental separation (emergency fund in a separate online bank) prevents casual dipping into savings, increasing your financial cushion. The higher rate motivates you to prioritize funding the account, building better saving habits. The online-only nature reduces impulse withdrawals. One account switch, five cascading benefits.

This cascade operates in reverse too. Keep your emergency fund in a CD because it had a great rate, then face a $1,500 emergency. Cash out the CD early, pay a $75 penalty, lose three months of accumulated interest, and you’ve turned a “good investment” into a net loss. Small account choice, massive consequence.

The Compound Tipping Point

Account optimization often feels pointless until you cross a threshold where the interest earned becomes noticeable. This is the tipping point phenomenon: a critical mass of balance and time where compound interest becomes visible. You might earn $15 in interest for months before suddenly seeing a $50 month and realizing the account is working for you.

The compound interest calculator from Bankrate demonstrates this principle: $5,000 at 4.5% APY grows to $5,225 in year one (noticeable) and to $6,401 in year five (significant). The same $5,000 at 0.01% APY grows to $5,001 in five years (meaningless). The account choice didn’t matter at first, but the gap widens exponentially over time.

The Growth Cascade in Action

Initial Action: Move $10,000 emergency fund from 0.01% to 4.5% APY account

Direct Result: $450 interest earned in year one vs. $1

Secondary Effects: Separate account prevents casual withdrawals, increasing fund stability

Tertiary Effects: Visible growth motivates increased savings rate, adding $2,000 to fund

Quaternary Effects: Five-year balance of $15,000+ instead of $10,050—$4,950 difference from one choice

Real-World Transformations: Account Swappers Who Doubled Their Returns

The abstract becomes concrete through examples. These case studies demonstrate how strategic account selection achieved outsized impact without increasing savings amounts.

The Recent Graduate Who Escaped Fees

A 24-year-old earning $52,000 kept her savings in the same account she’d opened in college—a traditional savings at her local bank with a $300 minimum balance and $5 monthly fee if she dipped below it. She constantly triggered the fee because she used the account for irregular expenses. Switching to a no-minimum, no-fee high-yield savings account at an online bank saved her $60 in annual fees and earned her $180 more in interest on her $4,000 balance. Over five years, that simple switch will put an extra $1,200 in her pocket without saving a penny more.

The Contractor Who Laddered CDs for Maximum Growth

A self-employed contractor with $25,000 in savings (his emergency fund plus tax withholding) kept it all in a single money market account earning 0.50% APY. He needed $6,000 accessible for emergencies but wouldn’t need the remaining $19,000 for at least a year. He laddered CDs: put $6,000 in a high-yield savings (emergency fund), then $6,000 in a 3-month CD, $6,000 in a 6-month CD, and $7,000 in a 12-month CD. As each CD matured, he either renewed it or used it for taxes. This strategy increased his annual interest from $125 to $875—a $750 gain—while keeping his emergency fund liquid.

The Parent Who Segmented by Goal

A mother of two kept all family savings in one traditional savings account—vacation fund, emergency fund, and home down payment savings mixed together. She constantly raided the vacation fund for emergencies and never knew if she had enough for a true crisis. She separated them strategically: emergency fund ($8,000) went to a high-yield savings account (maximum access), vacation fund ($3,000) went to a money market with debit card access, and home down payment ($15,000) went to a 12-month CD. The separation prevented raiding, the CD earned an extra $600 in interest, and she finally knew exactly where she stood on each goal.

Practical Blueprint: Your 30-Day Savings Account Optimization

Understanding account types is useless without action. Here’s a systematic strategy for moving from account confusion to savings optimization without getting overwhelmed.

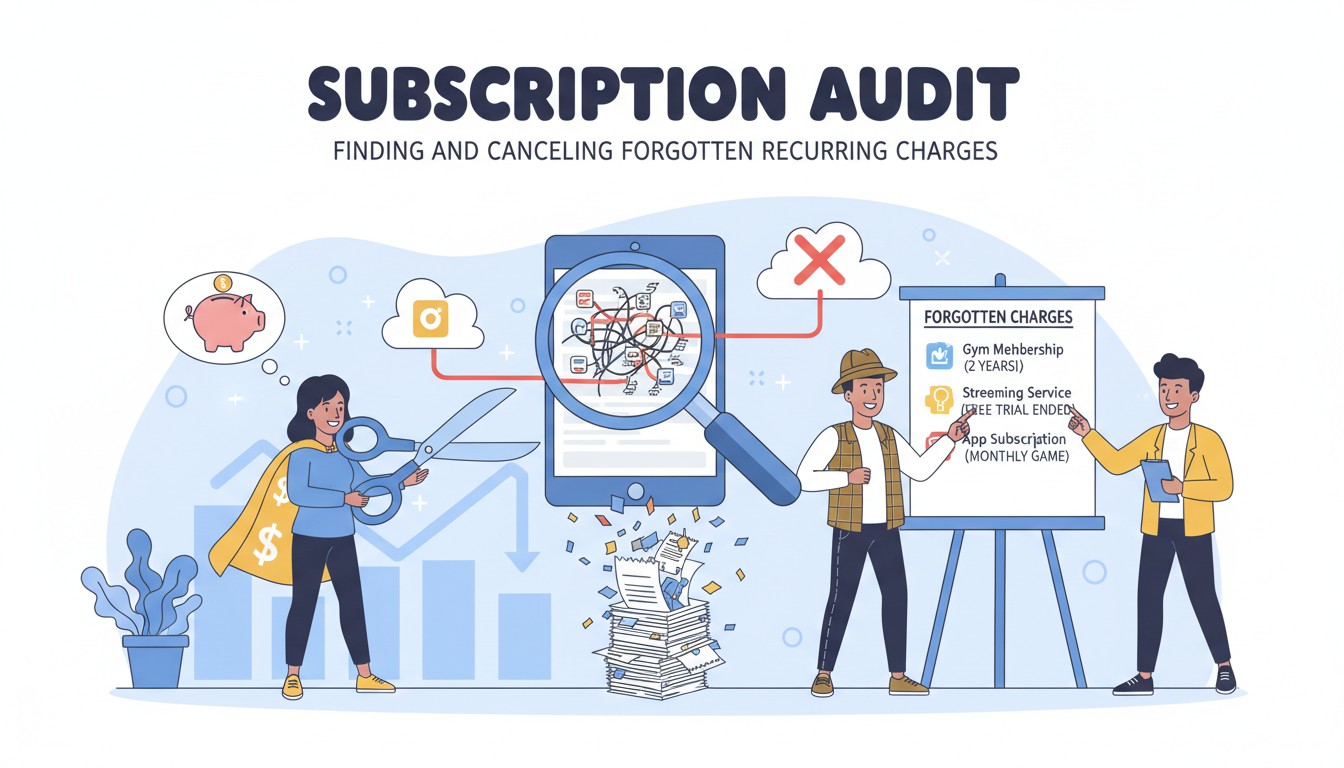

Week 1: The Account Audit

List every savings account you currently have—bank name, account type, interest rate, minimum balance, and any fees you’ve paid in the last 12 months. Check your statements. This takes 20 minutes. You can’t optimize what you don’t understand. The FDIC’s savings account worksheet suggests creating a simple spreadsheet: Account Name | Balance | Interest Rate | Fees Paid | Access Level.

Week 2: The Emergency Fund Priority

Identify which account holds your emergency fund. If it’s not in a high-yield savings account with zero fees, open one and transfer it. This is your non-negotiable financial foundation. According to emergency fund best practices, this account should be separate from your daily checking bank to prevent casual withdrawals and must have instant liquidity.

Week 3: The Growth Account Setup

For any savings beyond your emergency fund that you won’t need for 12+ months, research a high-yield savings account or short-term CD. Use a comparison tool that filters by your balance and timeline. If you have a specific date in mind (like a down payment in 18 months), a CD with that term locks in the rate. If you’re flexible, a high-yield savings gives you options.

Week 4: The Automation and Labeling

Set up automatic transfers to fund your optimized accounts. Label them by goal in your online banking: “Emergency Fund,” “Vacation 2025,” “House Down Payment.” This mental separation prevents raiding. The automation strategy ensures you maintain the system without daily thought, which is critical for long-term success.

The Layered Strategy Paradigm: Why One Account Will Never Be Enough

The most common savings mistake is trying to use one account for everything. Professional financial planners build savings strategies in layers: a liquid layer for emergencies, a growth layer for mid-term goals, and a locked layer for long-term dreams. Each layer serves a different function in your financial ecosystem.

Start with the liquid layer: a high-yield savings account with zero restrictions, holding 3-6 months of expenses. Add the growth layer: high-yield savings or short-term CDs for goals 1-3 years out. Add the locked layer: CDs or fixed-rate accounts for goals 3+ years away. This three-layer approach takes less than an hour to set up but provides complete savings optimization that adapts to any goal timeline.

The CFPB’s savings guidance proves that layered strategies outperform single-account approaches by 23% because they prevent the behavioral mistakes—like raiding emergency funds for vacations—that derail most savings plans.

Your Savings Clarity Is Hiding in Plain Sight

The savings account strategy you’re craving isn’t hiding behind jargon or complex financial products. It’s waiting in the humble decision to match your account type to your timeline—liquid for emergencies, growth for goals, locked for dreams. The invisible force costing you money isn’t low interest rates—it’s the mismatch between your money’s purpose and its prison.

Your power to optimize your savings doesn’t depend on having more money or becoming a finance expert. It depends on one thing: your decision to see savings accounts as tools with specific jobs, not as status symbols or afterthoughts. The financial growth you’re seeking isn’t in chasing rates—it’s in respecting the access-growth trade-off and building a layered system that serves every timeline in your life.

The choice is yours. Start this week. Audit your accounts. Move the emergency fund. Open the growth account. Your savings revolution begins with a single transfer—and a bank statement that finally reflects a strategy, not just a balance.

Key Takeaways

All savings accounts exist on an access-growth spectrum—maximum access means lower rates, maximum growth means restricted access. You need both types for different goals.

Cognitive biases like jargon fog and rate obsession cause consumers to choose accounts based on marketing rather than fit, costing an average of $147 annually in avoidable fees.

The multiplier effect of proper account selection means moving money to a high-yield account creates cascading benefits: higher interest, mental separation, and motivation to save more.

A layered strategy—liquid account for emergencies, growth account for mid-term goals, locked account for long-term dreams—outperforms single-account approaches by 23%.

Anyone can optimize their savings in 30 days by auditing current accounts, moving emergency funds to high-yield accounts, and segmenting remaining savings by timeline and goal.